Nivelo— Secure, Fast Payment Operations for PSPs & PEOs

Nivelo is a fintech startup that provides a secure, real‑time payment ops platform payroll service providers. When I joined, payroll operations were fragmented, manual, and error‑prone — leaving customers exposed to failed payments, delays, and compliance risk.

I designed Nivelo’s first unified payroll operations platform, replacing a patchwork of spreadsheets and ad‑hoc tools with a scalable, intuitive web interface. Within weeks, the MVP was in active use across multiple customers, validating our approach and enabling rapid iteration.

Impact:

Eliminated most manual steps in payroll review and approval

Gave customers visibility into payment issues before payroll runs

Enabled proactive fixes, including financing options to prevent NSFs and missed payroll

Role

First Product Designer

Responsibilities

Owned UX/UI and product design for Nivelo’s platform, from 0→1

Collaborators

Chief Product Officer, CEO, Engineering

Timeline

Q4 2022–Q2 2023

🧠 Problem

Payroll providers process millions of ACH transactions every pay cycle but lacked tools to know—before payroll ran—whether their clients were truly ready to fund and execute payments accurately.

This created real risk and operational strain—failed or misdirected payments could erode trust, trigger compliance issues, or delay employee wages. Operations teams were left scrambling to troubleshoot with limited context and no standardized process.

Without a unified system, operations teams relied on disconnected tools, spreadsheets, and reactive workflows to:

Verify clients had funds to cover payroll

Catch errors like incorrect employee bank account details

Predict potential funding shortfalls and offer short‑term financing to prevent missed payroll

These blind spots slowed response times, caused payment errors, and risked both employer and employee trust.

🎯 Goals

I set out to design and launch a product that would:

Surface transaction-level risk and readiness in real time

Provide clear, actionable insights to operations teams

Streamline decision-making with intuitive, triage-focused workflows

Build trust and transparency with customers processing sensitive payroll data

🛠️ My Role

As Nivelo’s first and only product designer, I led the platform’s design from 0→1.

Partnered directly with founder to define MVP scope and workflows

Interviewed early customers and Nivelo Ops staff to map current processes

Designed end‑to‑end UX for payroll preparation, issue detection, and resolution

Created interactive prototypes to validate flows before build

Supported engineers through QA and refinement

📋 Key Features

Transaction Risk & Readiness Triage – Centralized dashboard showing high-risk transactions, funding readiness, and supporting data to help teams prioritize and act quickly

Alert System & Workflow Tools – Custom alert logic, inline annotations, and workflow statuses to streamline investigation

Confidence Thresholds – Visual indicators to quickly interpret readiness or risk strength and improve decision quality

Audit Trails – Logged actions for transparency and regulatory compliance

Human-in-the-Loop Feedback – User feedback loops to confirm/dismiss predictions, improving the model over time

📈 Outcomes

Shipped MVP in under 3 months

Replaced fragmented, manual workflows with a unified, scalable platform

Enabled early customers to verify funding availability before payroll runs

Helped teams catch and correct errors—like invalid employee bank account details—before they blocked payments

Reduced time spent triaging failed or misdirected transactions

Increased operational confidence and shifted workflows from reactive to proactive

Became the foundation of Nivelo’s core offering and future product roadmap

Mapping the Ecosystem

Before designing any interfaces, I mapped how payroll moves through the broader ecosystem—who the players are, what data passes between them, and where readiness or risk issues surface.

The system-level map showed how Nivelo sits between payroll providers and payment processors, ingesting ACH files and transaction metadata, running real-time analysis, and automating actions like holds, alerts, or approvals before funds are released.

It aligned the team on what needed to be configurable, what needed to be real time, and where in the lifecycle we had the most leverage.

Diagrams showing where Nivelo fits within the payroll lifecycle

Setting the Foundation

With the ecosystem mapped, the next challenge was integrating Nivelo into the payroll provider–employer relationship without adding friction.

I mapped the full onboarding journey—where Nivelo appears, what data is required, and how signals influence downstream behavior. A service blueprint revealed inconsistencies between providers and helped us design a unified experience with room for flexibility.

This shaped early product requirements, including configurable rule templates, account state tracking, and automated decision logging.

Designing for Risk and Automation

Once onboarding was mapped, I focused on how the system would handle payroll data in motion. I helped define a modular workflow engine that could ingest ACH data, apply configurable rules in real time, and support both automated and manual resolution paths. This ensured flexibility for different employer tolerances and escalation protocols while flagging issues, triggering actions, and providing visibility into why they happened.

Designing the Experience

With the architecture in place, I focused on making the system usable and actionable for operations teams, turning complex signals into intuitive workflows. One of the earliest challenges was enabling our customers—payroll providers—to seamlessly onboard their employers into the system.

We designed an onboarding flow that fit naturally into the payroll provider's workflow, capturing the necessary configuration data. From the moment an employer was connected, Nivelo began surfacing early risks, errors, or inconsistencies. This insight from day one gave customers and employers immediate confidence and prevented costly errors before they could impact paychecks.

Embedded onboarding flow that allowed payroll providers to activate Nivelo for their employer customers while beginning risk and error detection from the very first run.

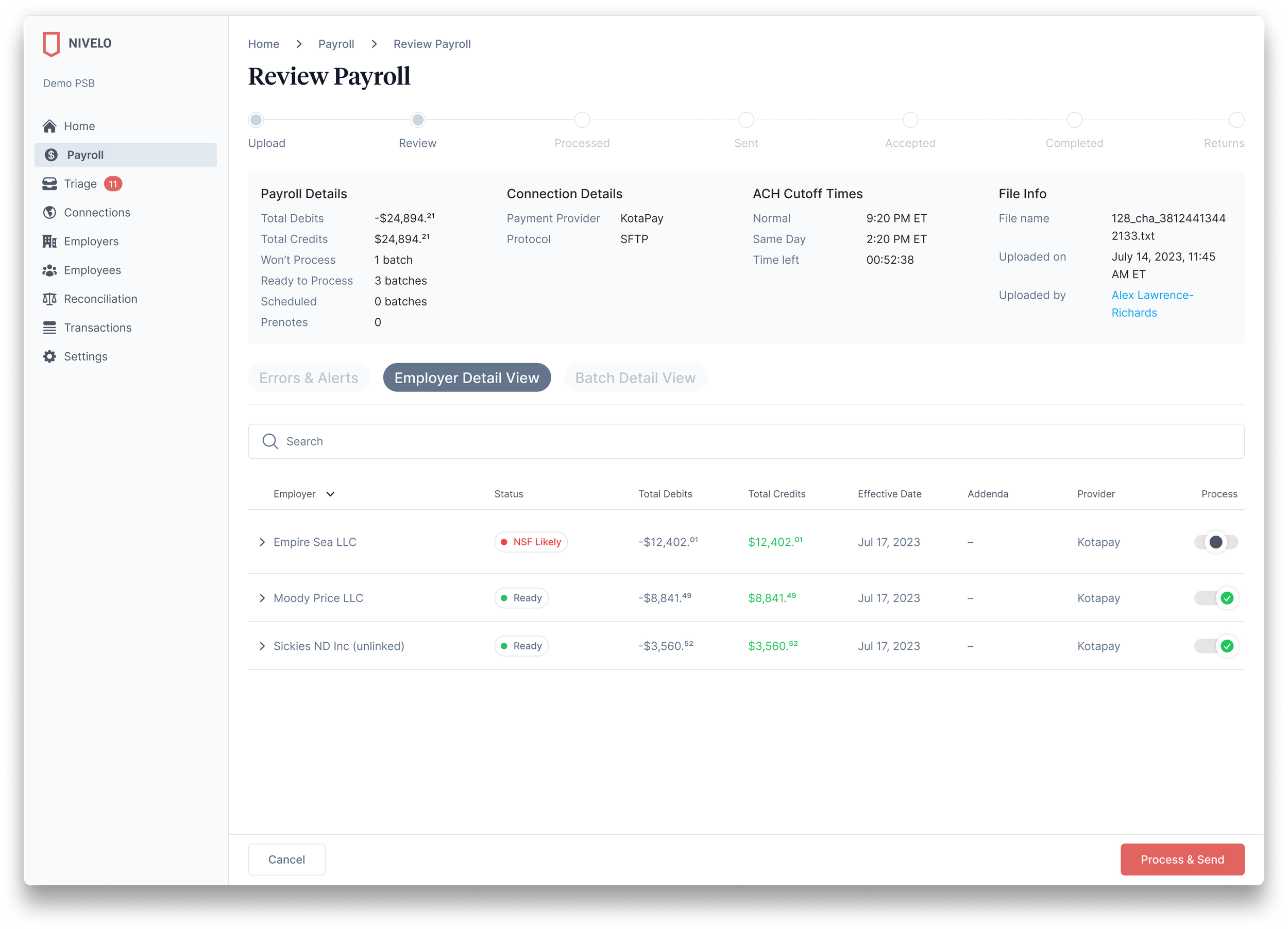

Parsing ACH Data at Scale

Nivelo’s ACH parsing engine surfaced errors, risks, and inconsistencies across millions of payroll transactions before payments were sent—giving operations teams a crucial intervention window.

By normalizing ACH batches in real time and flagging anomalies early, the platform let users review, resolve, and modify payment instructions directly within Nivelo.

I designed the transaction and batch view to make interventions intuitive, with clear status indicators, drill-down transaction details, and direct links to resolution workflows.

Batch-level monitoring interface. Surfaced errors, risks, and inconsistencies before payments were sent, enabling teams to review and modify payment instructions in real time.

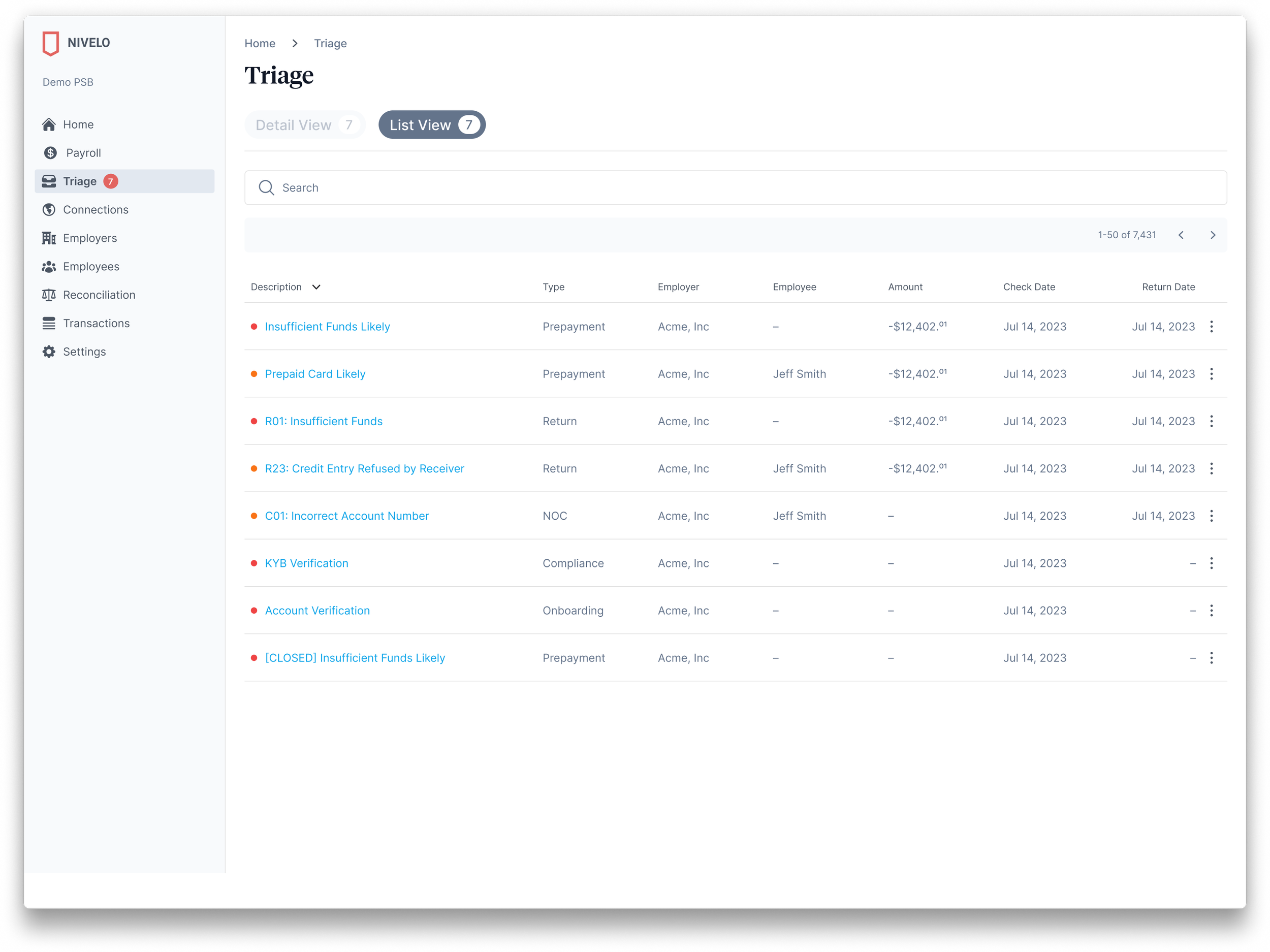

Managing Issues Transparently

When the parsing engine flagged an anomaly—whether a formatting error, failed transaction, or rule-based hold—the platform guided users to understand the issue and resolve it without breaking their workflow.

I designed issue detail views that put all context in one place: triggering condition, related transactions, history, and recommended actions.

Resolution paths were embedded directly in these screens, letting users approve, reject, or escalate issues without leaving the platform—reducing back-and-forth and improving resolution time.

Triage section offering global view of all issues

Issue detail screen showing trigger conditions, related transactions, and built‑in resolution actions.

Lessons Learned

Designing for early-stage B2B fintech meant staying laser-focused on clarity, trust, and speed of value delivery. The goal wasn’t feature richness—it was empowering payroll ops teams to catch issues early and take action with confidence. We built a tool that prioritized signal over noise, enabling users to shift from reactive troubleshooting to proactive resolution.

What worked:

Real-time insights—especially around funding and risk—helped surface trust, even when problems were detected

Replacing fragmented, manual tools with a single, centralized view reduced decision-making friction

Tight collaboration with early customers allowed us to validate assumptions and iterate quickly

What didn’t:

Initial MVP leaned too heavily into power-user complexity, creating a learning curve for less technical ops roles

Predictive features lacked clarity on confidence levels, leading to hesitation in early use

Internal stakeholders underestimated the importance of in-product education and framing

How we responded:

Simplified early UI surfaces to better prioritize key signals and reduce initial overwhelm

Clarified predictive language and introduced visual indicators to align with varying user mental models

Developed light in-product onboarding and contextual tips to help new users build trust in the system

This work reinforced a core lesson: in B2B fintech, speed and clarity are key drivers of adoption—and building for proactive action creates value not just for users, but for the business as a whole.